Expedia Travel Data Analytics to Forecast Travel Demand in Germany

Discover how Expedia travel data analytics helps forecast travel demand in Germany, optimize pricing, predict trends, and improve tourism business strategies.

In today’s hyper-competitive retail landscape, pricing has become a key battleground where small margins can determine market leadership. Brands and retailers must move beyond traditional methods and embrace Competitor Price Benchmarking to align with evolving customer expectations. In 2025, the retail ecosystem is driven by real-time data, AI-driven intelligence, and customer-centric pricing strategies

Accurate competitor monitoring not only ensures optimal price points but also helps prevent revenue leakage from poorly timed discounts or mismatched promotional campaigns. Businesses are increasingly using Real-time competitor price benchmarking and automated tools that capture market-wide price shifts across multiple platforms, enabling them to stay competitive without constant manual effort.

This report provides a detailed guide on how to perform Competitor Price Benchmarking for optimal pricing in 2025. Backed by real-world stats, tables, and actionable insights, we highlight methods for SKU-level benchmarking, cross-platform analysis, and competitor promotional monitoring. Finally, we explain how Actowiz Metrics empowers businesses with AI-powered price optimization solutions, providing the precision needed to maximize profits while maintaining market competitiveness.

The shift from static pricing models to real-time dynamic pricing has transformed retail in recent years. By leveraging Real-time competitor price benchmarking, businesses can monitor every competitor’s price update within seconds and respond strategically.

According to a 2025 market study, 62% of retailers using real-time price tracking improved profit margins by 18% compared to competitors without it.

Retailers are increasingly relying on Real-time competitor catalog monitoring to capture fluctuations across grocery, electronics, and fashion. This granular visibility ensures that businesses react quickly to competitor-driven promotions without falling behind.

| Year | Retailers Using Real-Time Tracking (%) | Avg. Margin Gain (%) |

|---|---|---|

| 2020 | 22% | 4% |

| 2021 | 29% | 6% |

| 2022 | 38% | 9% |

| 2023 | 47% | 12% |

| 2024 | 56% | 15% |

| 2025 | 62% | 18% |

By combining competitor insights with automated triggers, brands can detect undercutting, identify opportunities for premium positioning, and avoid profit erosion.

While real-time monitoring is critical, weekly trend-based insights reveal broader competitor strategies. Weekly competitor pricing strategy monitoring provides long-term visibility into discount patterns, promotional cycles, and recurring pricing moves.

A leading consumer electronics brand in India reported that weekly pricing audits helped reduce mismatched discount campaigns by 23% in 2024, saving millions in lost revenue. Retailers can integrate Competitor promotional pricing analysis to understand how rivals structure flash sales, festival offers, or clearance discounts.

| Year | Avg. Pricing Accuracy (%) | Revenue Uplift (%) |

|---|---|---|

| 2020 | 61% | 4% |

| 2021 | 66% | 7% |

| 2022 | 72% | 10% |

| 2023 | 78% | 14% |

| 2024 | 82% | 19% |

| 2025 | 87% | 22% |

This approach supports both tactical discounting and strategic pricing models, ensuring businesses do not get trapped in unnecessary price wars.

With thousands of SKUs per category, retailers need granular control. SKU-level price benchmarking enables item-specific comparisons across platforms, identifying competitive gaps at the product level. In 2025, multi-platform competitor pricing insights ensure consistency between marketplaces like Amazon, Walmart, and niche eCommerce players.

By adopting SKU-level benchmarking, FMCG retailers saw 15% improvement in conversion rates by aligning competitive pricing on fast-moving SKUs while retaining premium pricing on high-margin products.

| Year | Adoption Rate (%) | Conversion Rate Improvement (%) |

|---|---|---|

| 2020 | 18% | 3% |

| 2021 | 26% | 6% |

| 2022 | 34% | 8% |

| 2023 | 42% | 11% |

| 2024 | 49% | 13% |

| 2025 | 57% | 15% |

This method ensures that businesses avoid blanket discounts and instead focus on where competitive pricing actually drives incremental revenue.

AI is redefining pricing strategies in 2025. With AI-powered price optimization solutions, businesses can simulate competitor responses, predict elasticity, and maximize profit margins. AI models now integrate competitor discount monitoring to understand rival offers and adjust prices dynamically.

Research shows that AI-driven discount alignment improved revenue retention by 20% in 2024. By using Advanced Competitor Analysis Tools in 2025, retailers not only respond but also anticipate competitor behavior.

| Year | Retailers Using AI (%) | Avg. Margin Improvement (%) |

|---|---|---|

| 2020 | 12% | 3% |

| 2021 | 17% | 5% |

| 2022 | 23% | 7% |

| 2023 | 31% | 11% |

| 2024 | 39% | 16% |

| 2025 | 48% | 20% |

The ability to predict competitor promotions and counteract with data-backed pricing positions retailers for sustained growth.

Ecommerce retailers often manage multiple sales channels. Multi-platform competitor pricing insights allow brands to avoid inconsistencies across their pricing ecosystems. By applying competitor price gap analysis dashboard features, businesses identify which platforms offer better positioning and where alignment is needed.

According to a Statista report, retailers who standardized pricing across three platforms improved customer trust scores by 12% in 2025.

| Year | Avg. Price Consistency (%) | Customer Trust Improvement (%) |

|---|---|---|

| 2020 | 64% | 3% |

| 2021 | 69% | 5% |

| 2022 | 73% | 7% |

| 2023 | 77% | 9% |

| 2024 | 81% | 11% |

| 2025 | 85% | 12% |

This ensures both competitiveness and brand integrity across retail channels.

Data is the backbone of pricing strategy. With Extract Retail Competitor Pricing Data, retailers get actionable insights for long-term planning. By combining Competitor promotional pricing analysis, businesses build holistic market intelligence systems.

The adoption of Web Scraping with AI has enabled automated and precise competitor intelligence. Retailers now combine datasets for pricing, catalog shifts, and promotions, ensuring no blind spots in market monitoring.

| Year | Retailers Using Competitor Data (%) | Avg. Revenue Growth (%) |

|---|---|---|

| 2020 | 25% | 4% |

| 2021 | 33% | 6% |

| 2022 | 42% | 9% |

| 2023 | 51% | 13% |

| 2024 | 58% | 17% |

| 2025 | 64% | 21% |

Retailers leveraging competitor datasets outperform peers by double-digit margins.

Actowiz Metrics empowers businesses with advanced tools to master Competitor Price Benchmarking in 2025. By combining AI-driven insights, automation, and scalable Web Scraping API Services, Actowiz provides unmatched accuracy in monitoring competitor catalogs, discounts, and pricing strategies.

From SKU-level price benchmarking to real-time cross-platform insights, Actowiz equips retailers with dynamic dashboards and predictive models. Using Competitor price gap analysis dashboard tools, businesses can detect opportunities, prevent margin leakage, and implement Dynamic Pricing seamlessly.

Our solutions integrate Web Scraping with AI, ensuring precision in capturing competitor data at scale, while Retailer Intelligence features deliver actionable pricing strategies for sustained growth. Actowiz also supports Competitor promotional pricing analysis and multi-platform insights, giving brands the edge in fast-moving retail categories.

With expertise in pricing intelligence and deep industry knowledge, Actowiz ensures businesses stay ahead of pricing wars, maximize profits, and scale with confidence in 2025 and beyond.

As pricing competition intensifies in 2025, businesses must move beyond guesswork and embrace Competitor Price Benchmarking as a cornerstone of pricing strategy. From real-time competitor catalog monitoring to AI-powered price optimization solutions, the ability to analyze, predict, and respond ensures competitive resilience.

The years 2020–2025 show a clear trend: businesses that invested in competitor intelligence outperformed peers in profitability, customer retention, and long-term growth. By implementing SKU-level benchmarking, competitor discount monitoring, and multi-platform pricing insights, retailers build agile systems that adapt to every market shift.

Actowiz Metrics offers businesses the tools to lead this transformation with data-backed intelligence. Whether it’s extracting competitor pricing data, predicting discount patterns, or benchmarking across SKUs, Actowiz delivers precision, speed, and competitive advantage.

Ready to transform your pricing strategy in 2025? Partner with Actowiz Metrics today and harness the power of competitor intelligence for optimal growth.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Discover how Expedia travel data analytics helps forecast travel demand in Germany, optimize pricing, predict trends, and improve tourism business strategies.

A complete 5000-word guide for choosing a web scraping partner for enterprise projects. Learn from Actowiz Metrics’ U.S. case studies, API integration, and ROI results.

Actowiz Metrics builds real-time scraped data dashboards for USA retail, e-commerce, and competitor monitoring. Learn visualization best practices & case studies.

Actowiz Metrics uses sentiment scraping to track food & health trends, providing real-time analytics for businesses in India, UAE & beyond.

Discover how Hourly Zomato Menu Data Analytics helps restaurants optimize pricing, enhance menu strategy, and boost revenue with data-driven insights.

Learn how a U.S. retailer used Actowiz Metrics data APIs for competitive retail intelligence, inventory tracking, automated pricing & real-time insights.

Explore Nike vs Adidas Global Sportswear Data Analytics to uncover market trends, consumer preferences, and insights shaping sportswear dominance worldwide.

Discover the top-selling baby products on Amazon in 2025 by analyzing trends. Learn how to scrape bestselling baby products trends on Amazon for valuable market insights.

Explore effective strategies for Reese’s & Hershey’s Chocolate Trends Analytics on Amazon, overcoming challenges to deliver accurate and actionable insights.

Explore key omnichannel shopping trends in 2025 and learn how brands can future-proof their strategies to boost customer engagement and sales.

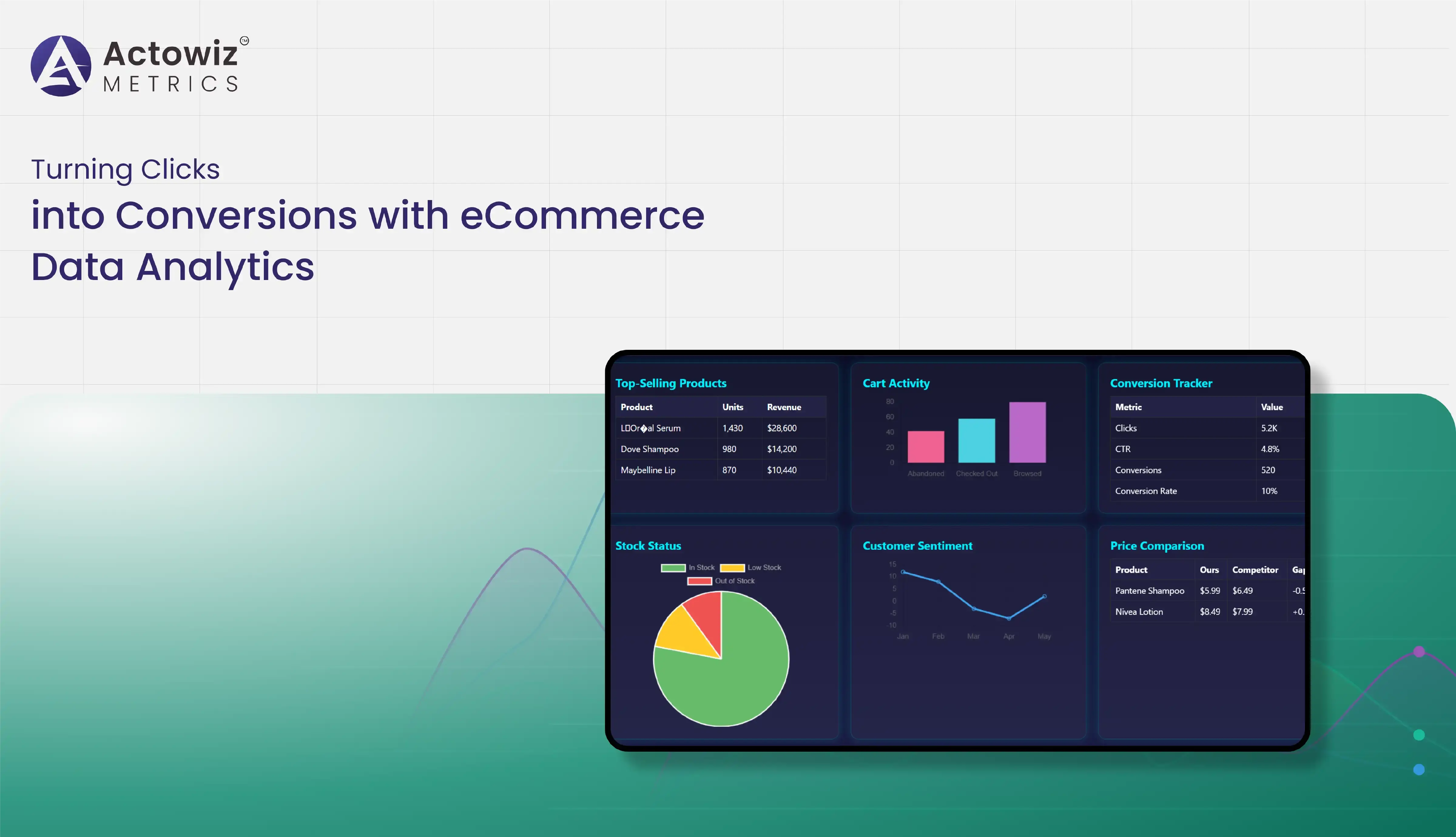

Explore how real-time eCommerce analytics tracks user behavior, optimizes pricing, and improves conversions at every stage of the online buying journey.

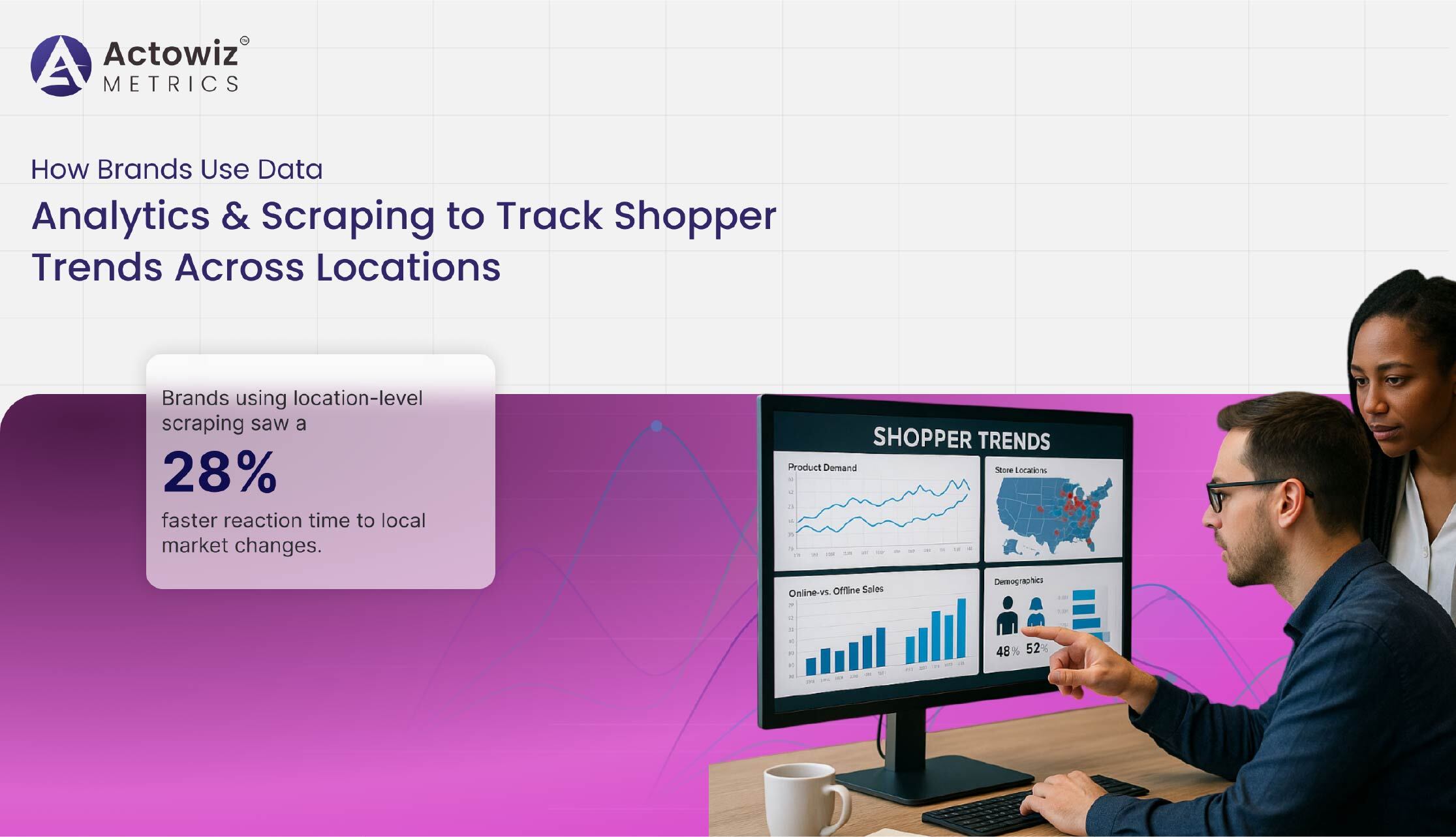

Discover how brands use data analytics and scraping to track shopper trends, optimize pricing, and monitor demand across different locations in real time.